When making a strategic decision on using the services of offshore experts, you should thoroughly analyze the market and consider not only developer salaries but also the characteristics of the tax systems of your would-be offshoring nation. It’s more favorable to choose nations with simplified tax systems without rigid regulations of employer-employee interactions. Of course, nations levy many types of taxes on corporations and citizens, so which taxes are most important to consider for offshoring?

We at Avicoma can break these taxes into two major groups: individual (employee) taxes and corporate taxes. From there, we need to consider the rates levied across different nations to see where you can find the most favorable tax policy for your business. That’s why today we are going to compare tax rates in different countries to identify the most competitive destinations for IT offshoring.

Individual Income Tax & Social Security Tax

Using data from Deloitte and Trading Economics, you can find comparison of individual income tax and social security taxes in the table below for selected Western European, Eastern European, and Baltic countries along with the United States:

Income Tax Rate

Denmark

Various progressive rates up to around 55.8%, excluding church tax

Latvia

23% of employment and business income, 15% on capital gains and 10% on other income from capital.

Netherlands

Progressive rates up to 36.55% on Box 1 income (enterprise, employment or housing); 25% on Box 2 income (income from substantial interests); 30% on Box 3 income (savings and investments) at a fixed presumed gain of 4%.

Poland

19%

Charged from distributed dividends

USA

Progressive rates up to 39.6%

Ukraine

IT businesses use unified taxation: Group II: Up to 20% of minimum wage for salaries below $60,480 and max 10 employees Group III: 5 % for revenue up to approx. $804,505. No limit on the number of employees.*

Social Security Tax Rate

Denmark

8%

Latvia

34.09% of an employee’s salary (23.59% paid by employer and 10.5% from the employee’s salary)

Netherlands

28.15%-32.60% with contributions based on employee gross salary less pension premium withheld from employee salary.

Poland

21.51%-26.26% with contributions based on salary (self-employed individuals’contributions are subject to specific rules); 9% health care contribution also required.

USA

12.4% consisting of old age, survivors and disability insurance (OASDI) Additional 2.9% for Medicare tax.

Ukraine

In 2016 the Single social contribution has been set at 22% of minimum wage that is as low as approx. $14

* Group III (independent contractors) is the most common simplified taxation system used by IT companies when doing business in Ukraine. Most company employees and freelancers working in Ukraine are hired as independent contractors, thus allowing for easy reporting and reduced tax obligations, which benefit companies and employees alike. Employers do not pay taxes on salaries while employees pay a fixed rate of 5% of their earnings instead of corporate income tax.

Taxes on Corporate Income & VAT

If you’re considering to open a representative office in one of these countries, it’s important to also understand their corporate taxation systems. In the table below you can see corporate tax rates in the same countries:

Corporate Tax Rates

Denmark

Corporate tax rate of 25% (20 % for profits up to EUR 200,000).

Latvia

15% Permanent establishments which operate 12 months or less can use a simplified tax regime. Under this regime, the tax is imposed on 20% of turnover.

Netherlands

20% on the first € 200,000 of taxable profits and 25% of profits exceeding that amount.

Poland

19% All enterprises with the status of “legal entity” must pay this tax. The IT sector has the opportunity to receive tax breaks on profits to 9% if you can prove that your activity matches the mark “copyright”.

USA

35% for corporations with taxable income of more than $18,333,333. Graduates rates starting as low as 15% apply to corporations with taxable income below this amount.

Ukraine

18% Businesses with turnover of more than $806,450 USD make advance CPT payments on a monthly basis, – other legal entities pay CPT after submitting tax declaration

Value Added Tax (VAT)

Denmark

25% Exemptions for this tax include the transport of people, insurance businesses, financial activities and other certain services.

Latvia

21% Reduced rate of 12% for certain goods and services. Some items are zero/related or exempt.

Netherlands

21% Reduced rate of 6% for certain goods and services.

Poland

23% This tax is accumulated in two cases: – Only when working with Polish customers -If the company’s annual turnover does not exceed $37,670 USD

USA

Not levied.

Ukraine

0% VAT exception does exist for software development service companies 20% standard tax rate, 7% for Healthcare products

What’s clear from both tables is that every nation has their own way of taxing corporations, residents, and citizens. Some nations, such as the Netherlands and the United States, impose high rates on both corporation and citizens. Please note these rates don’t include benefits that companies are often required to provide for their employees. The United States, for instance, requires businesses to pay part of their employees’ social security and medicare expenses.

Just as there are nations that levy high tax rates, however, there are others that levy low rates.

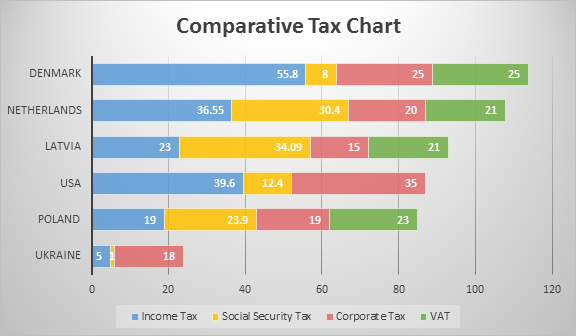

Latvia only levies a 15% corporate tax rate, and taxes citizens a flat percentage on different income categories. Low tax rates coupled with exchange rates can make certain nations attractive for seeking quality offshoring resources. Here you can see the visual representation of information on tax codes:

Why Ukraine as a Sought After Destination for IT Services

With a simplified taxation system of 5% and no VAT imposed on software development service companies, Ukraine is an attractive nation for IT Western European and North American companies to conduct business in. In fact, the IT Ukraine Report explains that the United States is the destination for 80% of Ukraine’s IT services. The United States is also Ukraine’s largest joint research and development activities partner, followed by European Union nations and Israel.

Conclusion

Every nation is different, from customs to traditions to the way they handle taxes. When it comes to conducting business abroad, understanding tax codes are vital for your bottom line.

Some attractive have strong IT specialists while others have employees whom you can hire at reasonable salaries with low taxation requirements. Ukraine is unique in that it offers the best of both worlds, and that’s where we at Avicoma come in. Our team has years of experience working with companies around the world on projects of all sizes. Saving money is great, but not at the expense of quality work. With the Avicoma team, you truly get the best of both worlds.

Disclaimer

Data available is valid as of July and August 2016. Please note that this blog post serves as for information purposes only and does not constitute as legal advice. If you have found any discrepancies in this post, please let us know by contacting us directly.

In addition, when a group of countries near each other enact a flat tax, it creates a race towards the bottom; in order to compete, nations must keep on lowering their tax rates, a problem which could lead to fiscal instability.